CDTFA Responsible Person Questionnaire for Dual Sales Tax Liability Determination

When conducting its investigation to determine whether an employee or owner is a responsible person for purposes of applying dual-liability for the unpaid taxes, the California Department of Tax & Fee Administration (CDTFA) will first look to internal records (such as return filings) and public records (such as those on file with the Secretary of State) to see who are potentially responsible persons. Once those individuals are identified, they will reach out to them directly and ask for information orally, for documents such as bank statements and cancelled checks, and for completion of a Responsible Person Questionnaire.

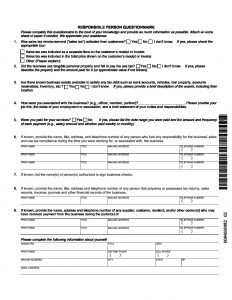

Click the image above for the full PDF copy.