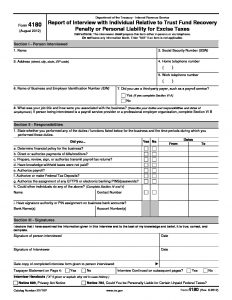

IRS Form 4180 Responsible Person Interview (2012)

IRS Form 4180, titled “Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes,” is the IRS’s interview questionnaire for payroll tax cases where the Trust Fund Recovery Penalty may be applied. This form (the PDF may be viewed by clicking the image above) is used by the IRS as the road-map for an interview of a potentially “responsible person” when the IRS conducts a Trust Fund Recovery Penalty investigation under Section 6672 of the Internal Revenue Code. From 2012 version of the IRS Form 4180, the IRS’s responsible person interview questions can be anticipated.

The IRS does not typically provide this form to taxpayers in advance of the interview, with the revenue agent or IRS revenue officer preferring to use the element of surprise to obtain what they, often mistakenly, believe will be more candid answers. However, answers to questions under the stress of an in-person interview with the IRS, without having time to adequately consider the exact meaning or purpose of the question, can often be incorrect or imprecise despite the best of intentions. For that reason, it is best practice to review an IRS Form 4180 before the IRS conducts a responsible person interview where payroll or employment taxes are at issue. Once the interview is over, the IRS agent or officer will ask the taxpayer to review and sign the form under penalty of perjury, often insisting it be done on the spot.

After the IRS Form 4180 Responsible Person Interview

The purpose of the IRS Form 4180 responsible person interview is to garner support for the Trust Fund Recovery Penalty. The Trust Fund Recovery Penalty is a serious and potentially-life changing penalty in and of itself because it makes one person responsible for the withholdings belonging to all the employees of a business. Moreover, the penalty is not dischargeable in bankruptcy (although tax attorney Daniel Layton has experience compromising the penalty via IRS Offer in Compromise procedures). Finally, although the government does not treat every violation of the requirement to pay over trust fund taxes as a criminal act, the 9th Circuit in United States v. Easterday, 564 F.3d 1004 (9th Cir. 2008), held that neither bad faith nor evil intent are necessary to find criminal culpability. Rather, violation of a known legal duty, which can be shown by the taxpayer’s payment of other company bills and pattern of nonpayment of the IRS while knowing he was required to pay over the employment taxes, was sufficient. Effectively, the same standard for application of the civil trust fund recovery penalty under 26 U.S.C. § 6672 applies for proving criminal failure to pay over taxes in violation of 26 U.S.C. § 7202.

For these reasons, whenever the prospect of civil personal liability for failure to pay over trust fund employment taxes exists and there is a rational fear of being held to be a “responsible person” for Trust Fund Recovery Penalty purposes, I would suggest contacting tax counsel experienced in these cases.

The IRS may update its forms at any time. The above form, revised as of August 2012, is no longer used, but is substantially similar to the 2020 version and adequate for preparation for your interview. Clients of our firm are provided a recent version of the form for preparation purposes.